- Find the best broker for your trading needs

- Compare spreads, fees, and platforms

- Read in-depth reviews and analysis

Best Forex Trading Demo Accounts in India 2024

These are the best demo accounts in India for 2024

According to our testing and research, these are the best demo trading accounts in India for 2024.

1.Octa

2. Ava Trade

3. HFM

Demo accounts are the best way for beginner traders to learn to trade Forex without risking their money. But demo accounts are also necessary for testing new strategies in a risk-free environment. In this guide, we explain why it’s important to use a demo account, tips to get the most from your demo account, and common mistakes to avoid. The brokers below not only offer demo accounts that closely mirror a live trading environment but are also well-regulated entities that provide excellent educational resources and maintain low trading costs on their entry-level accounts.

60-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Find Your Ideal Forex Broker

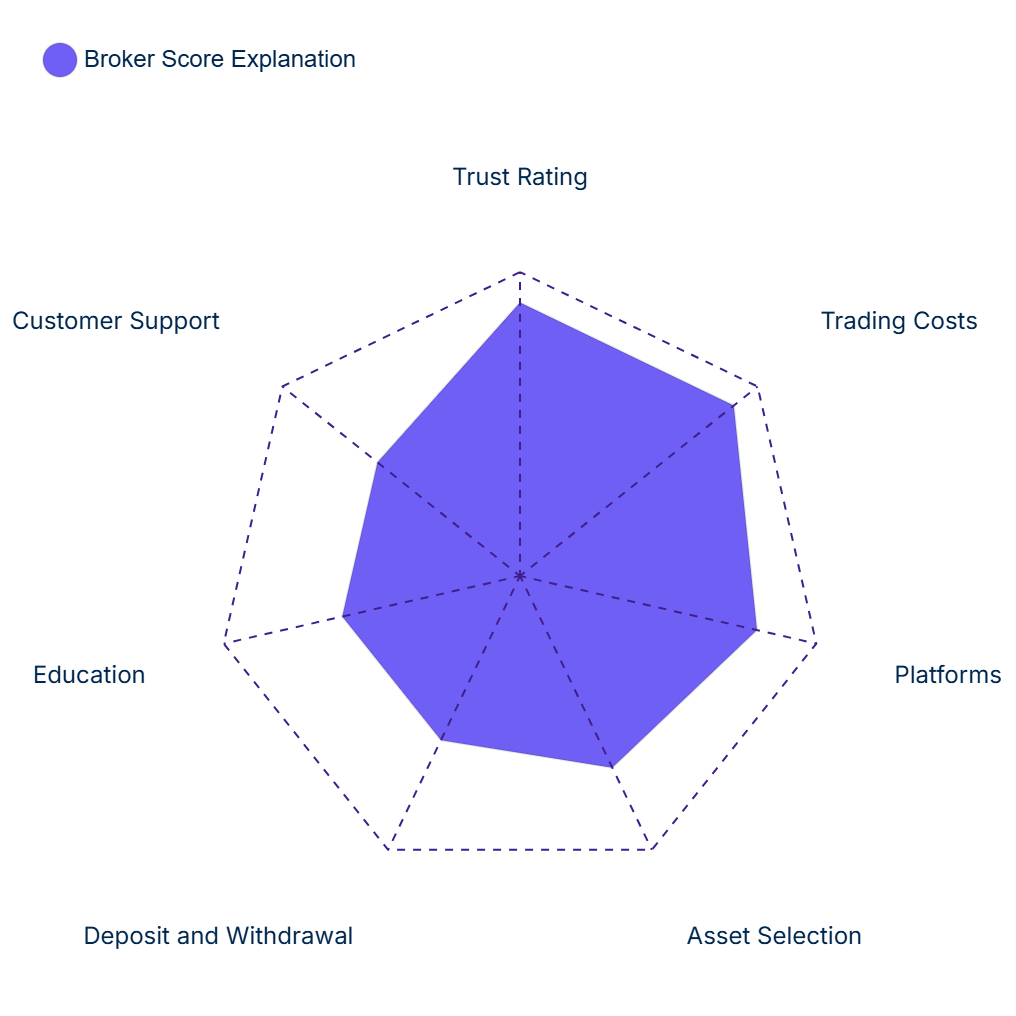

How Brokers Are Scored

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

Why we like it

Octa’s spreads are some of the tightest in the industry for an account with only a 20 USD minimum deposit and no commission – as low as 0.6 pips on the EUR/USD. It also has a great proprietary trading platform and trading app, which are both user-friendly and feature-rich.

Drawbacks

is limited compared to

other similar

brokers.

Min. Spread

Trading Cost

USD 6

Min. Deposit

| Trust Rating | 4 |

| Trading Conditions | 4.5 |

| Platforms | 4.5 |

| Education | 4.5 |

| Beginner Friendly | 4 |

| Assets Available | 4 |

| Analysis Research | 5 |

| Deposit & Withdrawal | 5 |

| Overall Rating | 4.37/5 |

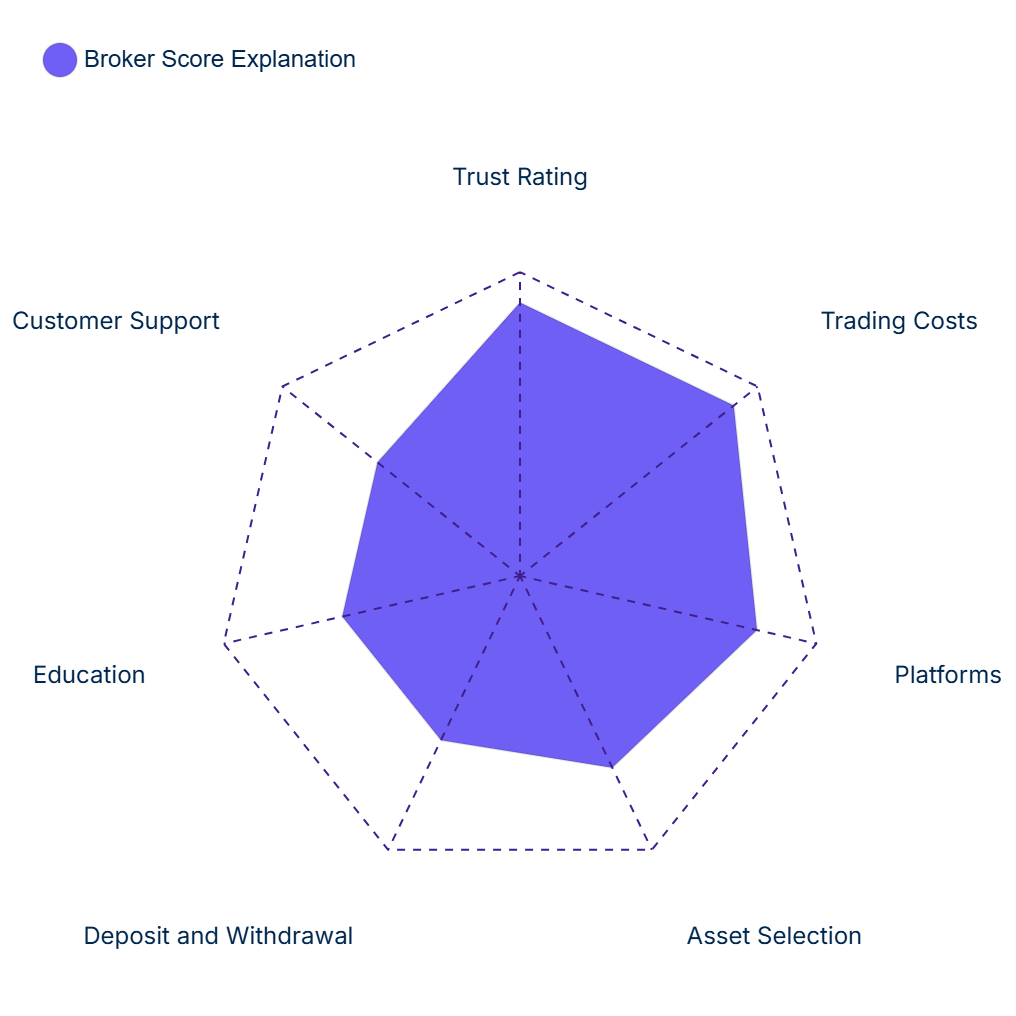

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

Why we like it

Octa’s spreads are some of the tightest in the industry for an account with only a 20 USD minimum deposit and no commission – as low as 0.6 pips on the EUR/USD. It also has a great proprietary trading platform and trading app, which are both user-friendly and feature-rich.

Drawbacks

is limited compared to

other similar

brokers.

Min. Spread

Trading Cost

USD 6

Min. Deposit

| Trust Rating | 4 |

| Trading Conditions | 4.5 |

| Platforms | 4.5 |

| Education | 4.5 |

| Beginner Friendly | 4 |

| Assets Available | 4 |

| Analysis Research | 5 |

| Deposit & Withdrawal | 5 |

| Overall Rating | 4.37/5 |

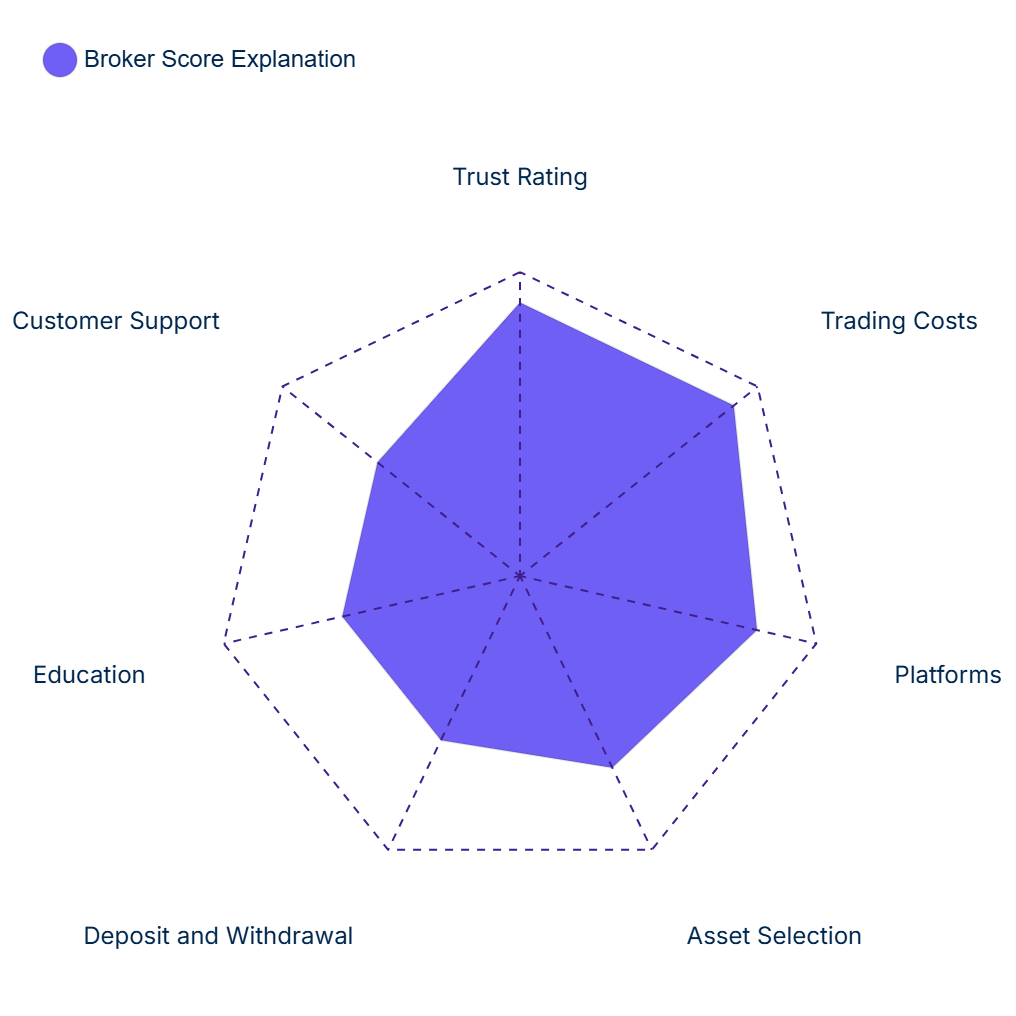

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

Why we like it

Octa’s spreads are some of the tightest in the industry for an account with only a 20 USD minimum deposit and no commission – as low as 0.6 pips on the EUR/USD. It also has a great proprietary trading platform and trading app, which are both user-friendly and feature-rich.

Drawbacks

is limited compared to

other similar

brokers.

Min. Spread

Trading Cost

USD 6

Min. Deposit

| Trust Rating | 4 |

| Trading Conditions | 4.5 |

| Platforms | 4.5 |

| Education | 4.5 |

| Beginner Friendly | 4 |

| Assets Available | 4 |

| Analysis Research | 5 |

| Deposit & Withdrawal | 5 |

| Overall Rating | 4.37/5 |

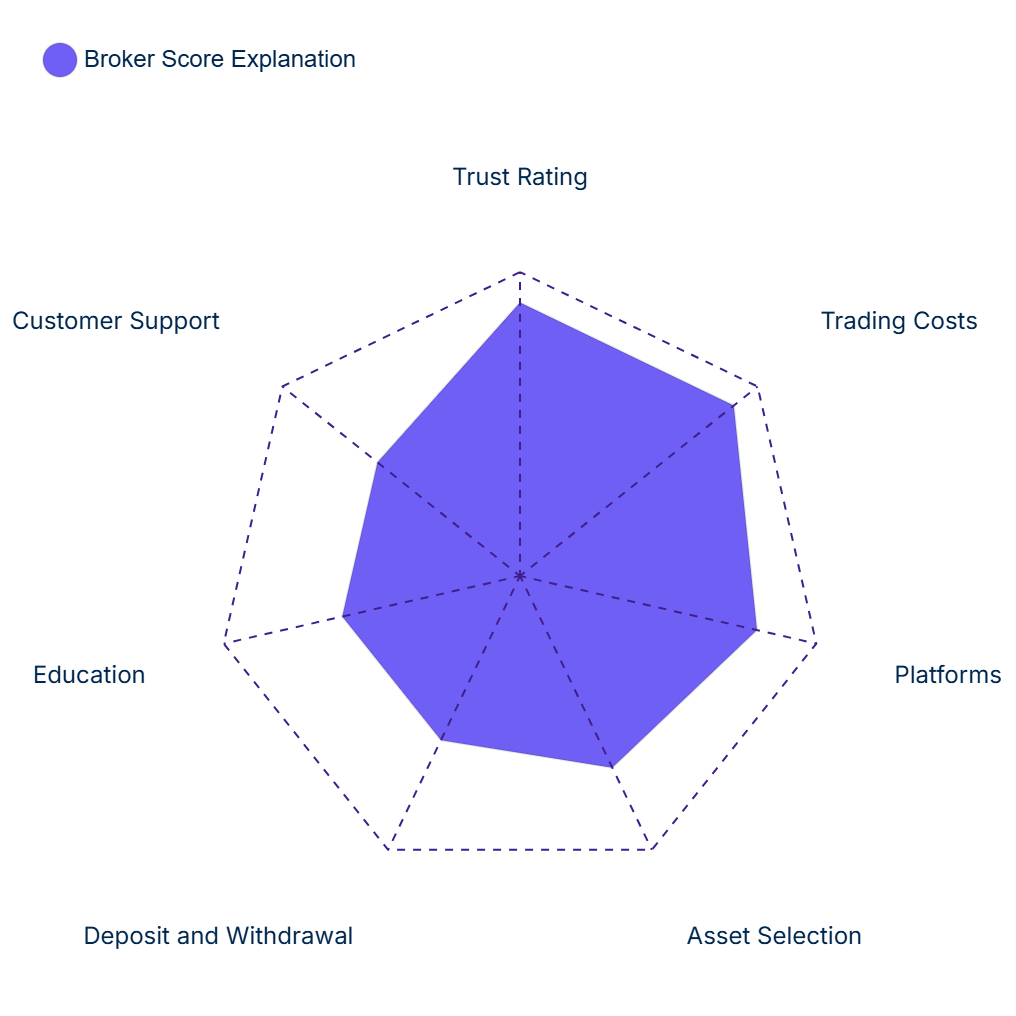

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

When comparing the best forex brokers in India, we:

- Confirmed that the brokers were regulated by top-tier authorities to ensure trader protection.

- Assessed the brokers’ trading fees and platform options for Indian residents by opening a live account and comparing the spreads on each instrument and platform to other brokers.

- Checked the number of tradable instruments available through the broker for traders in India.

- Reviewed the broker’s educational material and range of sources (such as e-books, webinars, glossary etc), to make sure they cater to all levels of traders, especially beginners.

- Assessed the broker’s market analysis, including whether it is curated by an in-house research team or third-party providers, the quality of the material, and how frequently it’s updated.

- Examined deposit and withdrawal options, costs and times for Indian residents, e.g. if it’s possible to use instant banking and credit cards and what, if any, fees are involved.

- Contacted customer support through the various channels offered by brokers, checking response time, service quality and whether or not they have a dedicated Indian support team and phone number.