Best Forex Brokers in India

When choosing a Forex broker, it’s important to consider the financial aspects and the personal fit. We have thoroughly evaluated FCA-regulated and other well-regulated brokers that accept India traders. Your feedback is an important part of this evaluation, and we always incorporate the views of real traders when we make a recommendation. With our comprehensive guide, traders of all budgets and preferences will find a broker that fits their needs.

Below is our list of the top India brokers in 2026 which we have identified based on our hands-on analysis. They have been selected for their trustworthiness, low trading costs, range of instruments, and the quality of their educational content.

The majority of retail traders (60-90%) lose money when trading Forex and CFDs. Before trading, assess whether you fully understand how CFDs and leveraged trading operate and if you can manage the high risk of potential losses. We may earn a commission when you click on links to the products we review. For more details, please read our advertising disclosure. By continuing to use this website, you agree to our Terms of Service.

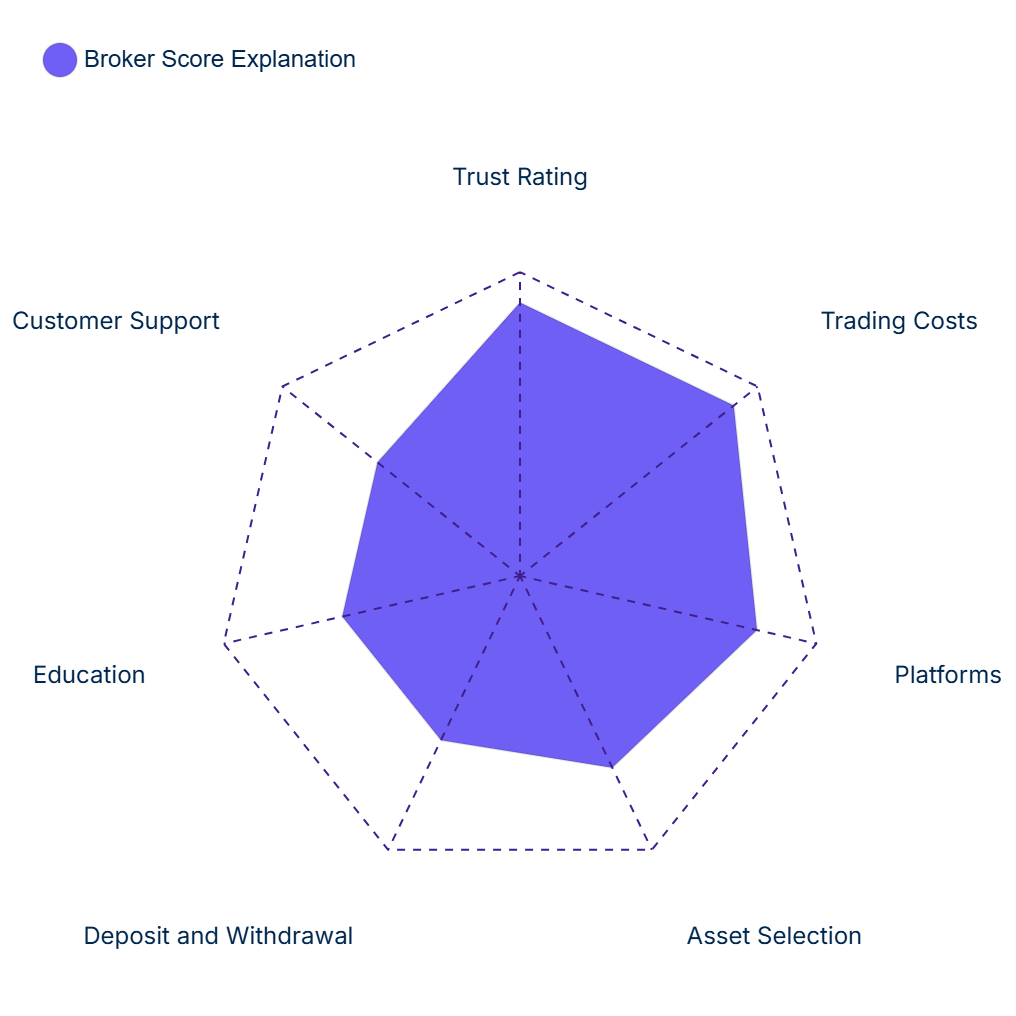

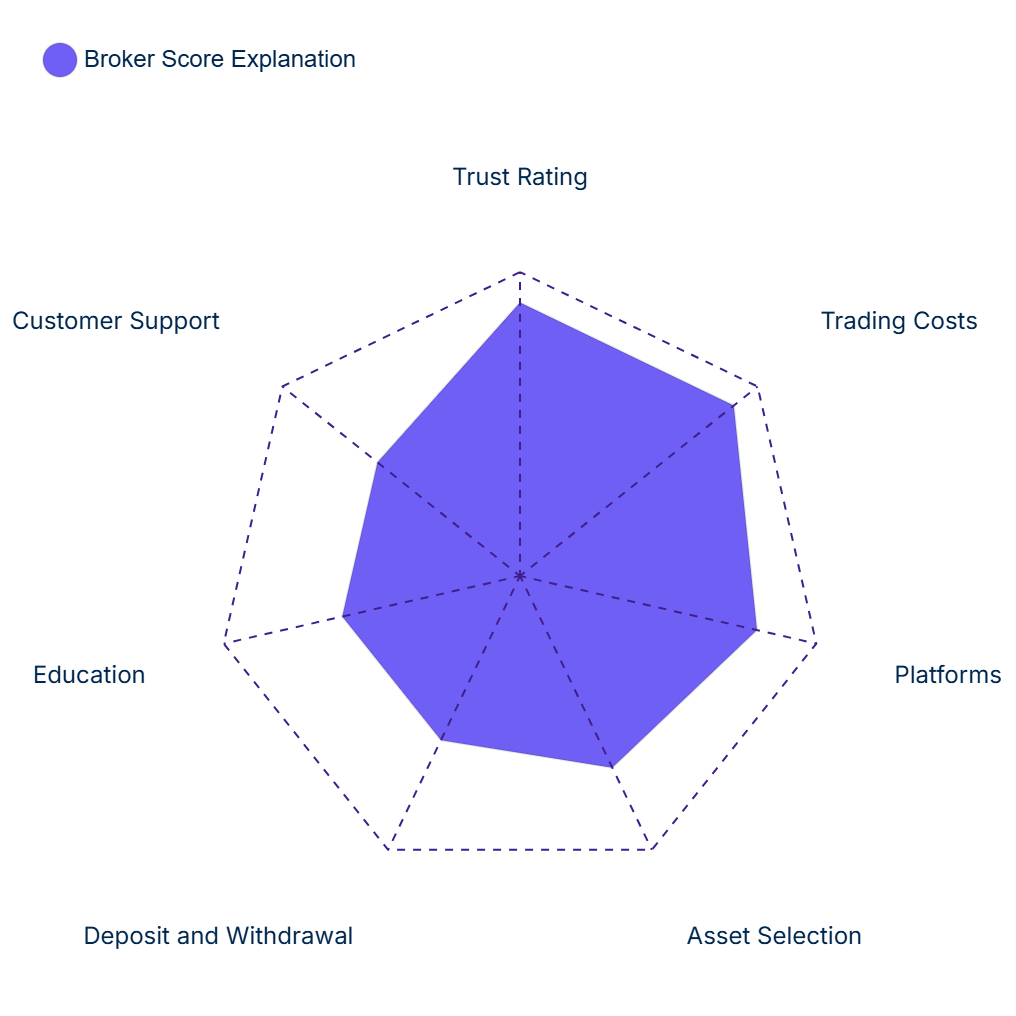

How Brokers Are Rated

Indiaforexbrokerinfo’ Broker Score and Trust Rating constantly evolve to reflect the forex market’s dynamics. We ensure transparency by incorporating regulator data and user insights. Our in-depth reviews consider over 200 metrics across seven key categories. The radar chart to the left shows how important each category is when calculating a broker’s final score.

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

XtremeMarkets stands out for serious beginners and more experienced traders looking for a trusted broker with strong MetaTrader support. It offers a low-cost commission-based account with extremely tight spreads and a minimum deposit of just 100 GBP, making it accessible to all levels of traders.

Why we like it

We like that XtremeMarkets offers tight spreads, starting from 0.0 pips on the EUR/USD for its commission-based accounts, and some of the industry’s lowest commissions. Furthermore, XtremeMarkets supports a wide range of currency pairs, provides helpful education materials and offers fast and free withdrawals.

Drawbacks

Despite its strengths, XtremeMarkets has some limitations, such as a smaller range of only around 2000+ financial instruments – whereas competitors like HFM offer 1200+ assets for trading. The commission-free entry-level account also starts at 0.0 pips on the EUR/USD, which is wider than other similar brokers

Min. Spread

0.0 pips

Trading Cost

USD 5

Min. Deposit

USD 10

| Trust Rating | 4.9 |

| Trading Conditions | 4.8 |

| Platforms | 4.7 |

| Education | 5 |

| Beginner Friendly | 5 |

| Assets Available | 4.9 |

| Analysis Research | 5 |

| Deposit & Withdrawal | 5 |

| Overall Rating | 4.8/5 |

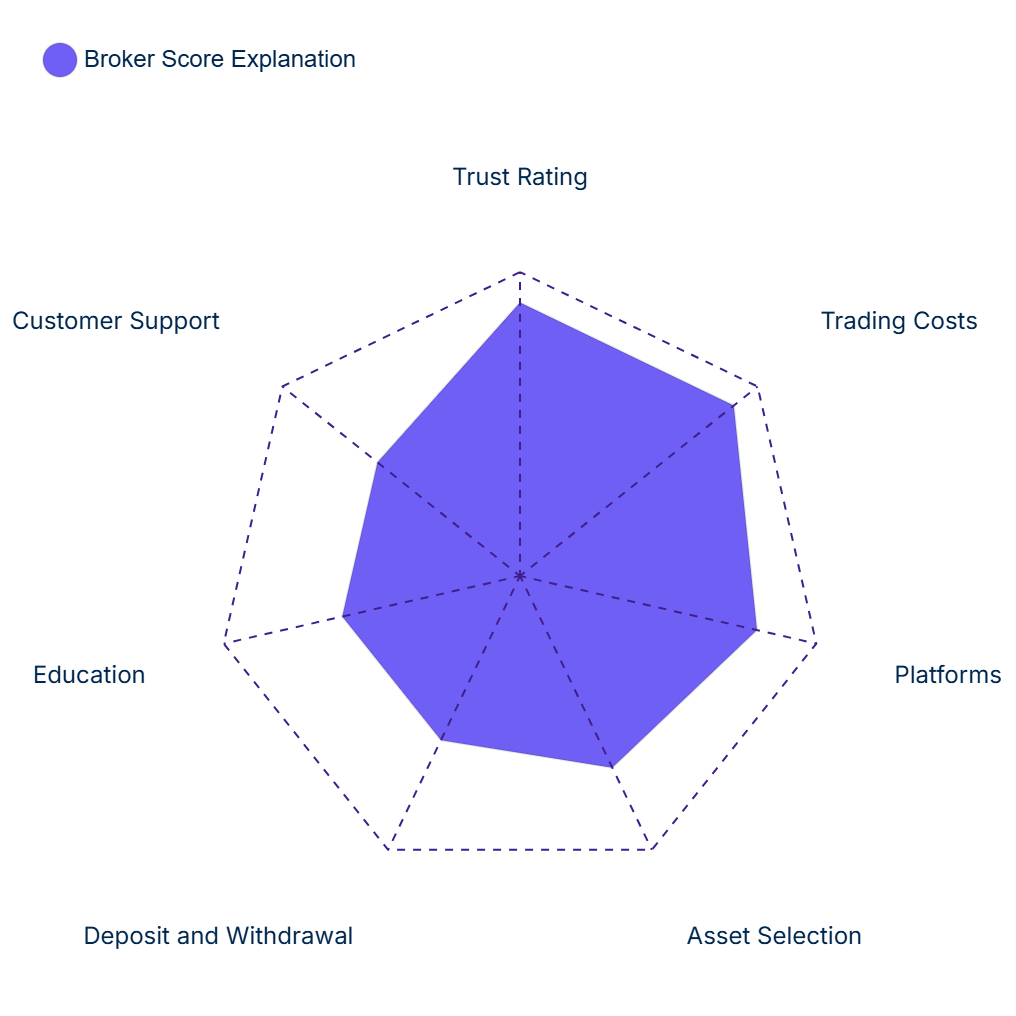

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

With a low minimum deposit, low trading fees, and outstanding customer service, XM is a good choice for beginner traders

Why we like it

XM spreads are some of the tightest in the industry for an account with only a $ 5 minimum deposit and no commission – as low as 0.6 pips on the EUR/USD. It also has a great proprietary trading platform and trading app, which are both user-friendly and feature-rich.

Drawbacks

Despite its strengths, XM has some limitations, such as a smaller range of only around 300 financial instruments. The commission-free entry-level account also starts at 0.6 pips on the EUR/USD, which is wider than other similar brokers.

Min. Spread

Trading Cost

$6

Min. Deposit

$5

| Trust Rating | 3 |

| Trading Conditions | 2.5 |

| Platforms | 3 |

| Education | 3 |

| Beginner Friendly | 3 |

| Assets Available | 3 |

| Analysis Research | 3 |

| Deposit & Withdrawal | 3 |

| Overall Rating | 3/5 |

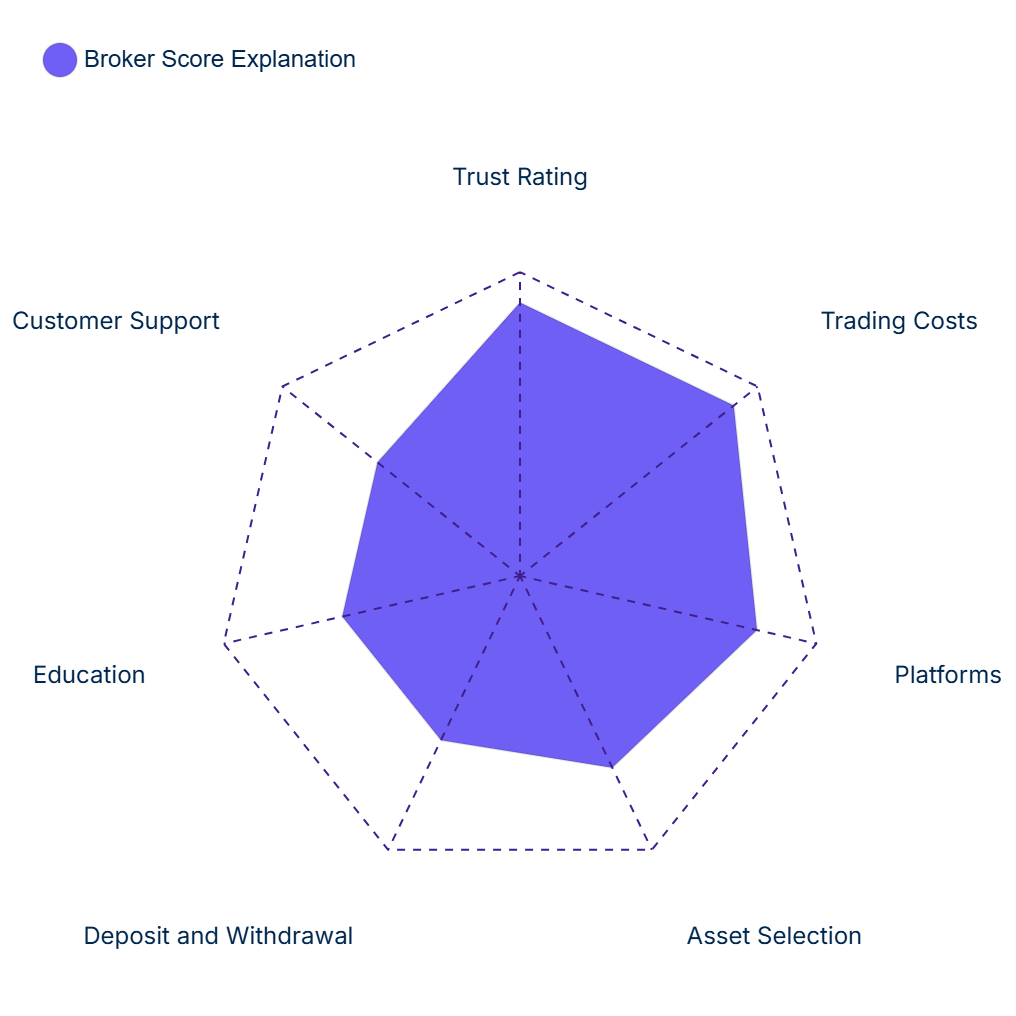

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

Best for

Beginners who want to take advantage of Exness excellent education and analysis

Why we like it

It’s not just the great education that we like, Exness also has the a huge range of assets to trade and low trading costs

Drawbacks

One minor gripe is that Exness only accepts bank transfers and credit/cards for deposits and withdrawals.

Min. Spread

0.7 pips

Trading Cost

GBP7

Min. Deposit

$100

| Trust Rating | 3.8 |

| Trading Conditions | 3.9 |

| Platforms | 4.5 |

| Education | 3.8 |

| Beginner Friendly | 4 |

| Assets Available | 4 |

| Analysis Research | 4.5 |

| Deposit & Withdrawal | 4 |

| Overall Rating | 4/5 |

- Trust Rating: Assessment of broker reliability and reputation

- Trading Costs: Spreads and fees for clear comparisons

- Platforms: User-friendliness and features

- Asset Selection: Forex, stocks, and other available instruments

- Deposit and Withdrawal: Simple and free deposits & withdrawals

- Education: Support for beginners and developing traders

- Customer Support: Accessibility, responsiveness, and expertise

When comparing the best forex brokers in India, we:

- Confirmed that the brokers were regulated by top-tier authorities to ensure trader protection.

- Assessed the brokers’ trading fees and platform options for Indian residents by opening a live account and comparing the spreads on each instrument and platform to other brokers.

- Checked the number of tradable instruments available through the broker for traders in India.

- Reviewed the broker’s educational material and range of sources (such as e-books, webinars, glossary etc), to make sure they cater to all levels of traders, especially beginners.

- Assessed the broker’s market analysis, including whether it is curated by an in-house research team or third-party providers, the quality of the material, and how frequently it’s updated.

- Examined deposit and withdrawal options, costs and times for Indian residents, e.g. if it’s possible to use instant banking and credit cards and what, if any, fees are involved.

- Contacted customer support through the various channels offered by brokers, checking response time, service quality and whether or not they have a dedicated Indian support team and phone number.

Frequently Asked Questions

Do I Need a Broker to Trade Forex?

Yes, a broker is essential for trading Forex. Forex trading involves complex operations and high costs, as brokers connect traders to the global Forex market. Market makers, a type of broker, purchase large trading positions and sell them in smaller sizes to traders. Alternatively, ECN or DMA brokers directly send traders’ orders to the Forex market.

Both types of brokers require significant capital and technical expertise to maintain their trading platforms.

How Much Does It Cost to Trade Forex?

Forex trading costs depend on the assets you trade, the volume, and your broker’s fee structure. The two main costs are the spread and commission. The spread is the difference between the buying and selling price of a currency, typically measured in pips. The commission is a fee charged when opening or closing a trade, often around 3.50 USD per lot per side.

Other fees, such as for withdrawals or VPS hosting, may also apply. It’s important to calculate your costs as they impact your profitability.

Do Brokers Charge Other Fees?

In addition to trading fees, brokers may charge non-trading fees, such as swap/rollover fees (for holding positions overnight), inactivity fees, and withdrawal fees. Brokers may also charge for premium services like VPS hosting and access to advanced tools or trading platforms.

Why Is Broker Regulation Important?

Regulation is crucial for protecting your funds and ensuring ethical and legal operations. Regulated brokers adhere to strict standards regarding capital adequacy, client fund segregation, and compliance, ensuring a secure and fair trading environment.

What Are the Best Trading Platforms?

Top platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer advanced charting, automated trading, and customizable features. Some brokers offer proprietary platforms that can be more user-friendly and accessible via browser or mobile.

What is a Forex Trading App?

Forex trading apps allow you to trade on your mobile device, offering the convenience of trading on the go. While they can help manage positions and access real-time data, the small screen size and internet reliability can limit detailed analysis, especially in volatile markets.

What Else Can I Trade with a Forex Broker?

Many brokers offer various assets beyond Forex, including stocks, indices, commodities, and cryptocurrencies (though certain countries, like India, have restrictions on cryptocurrency trading). These are typically traded through CFDs, which allow traders to speculate on price movements without owning the underlying asset.

What Should Beginners Look for in a Forex Broker?

Beginners should seek well-regulated brokers with low minimum deposit requirements (e.g., 100 GBP or less), low trading fees, and features like negative balance protection and responsive customer support. A quality educational section with tutorials and webinars is also important.

Which Forex Brokers Offer the Best Demo Accounts?

The best demo accounts offer unlimited access to practice trading in real market conditions. These accounts help you test strategies without risking real money. Look for brokers that provide good educational resources alongside their demo accounts.

What Is Leverage?

Leverage allows you to control a larger position with less capital, amplifying potential profits (or losses). In India, brokers regulated by the FCA typically offer leverage up to 30:1 for retail traders. Offshore brokers may offer higher leverage, but this comes with greater risk.

Is Forex Trading Taxable in India?

Yes, Forex trading may be subject to either income tax or capital gains tax, depending on the type of trading and personal circumstances. Spread betting is typically tax-free, while CFD trading may be subject to capital gains tax, with the rate depending on your income.

For further details, contact a tax consultant or HM Revenue and Customs.

Latest Brokers

FXTM

FxPro

XTB

Tickmill

AvaTrade