FP Markets Review

Main summary

Owned by an Australian private limited group of companies, FP Markets is located in a small Caribbean nation called Saint Vincent and the Grenadines.

The company has made its name by understanding its clients’ needs and has won more than 40 industry awards so far. The customer service is outstanding and available 24/5.

FP Markets was established in 2005 and is regulated by CySEC (Cyprus Securities and Exchange Commission) in Europe, and by (ASIC) Australian Securities and Investment Commission in Australia.

In today’s review of FP Markets, we’ll discuss what makes the broker stand out and what features are important to take into consideration while choosing a broker. Follow our detailed review of FP Markets to find out more.

Pros and Cons

Pros

- Regulated by CySEC and ASIC

- Offers access to MetaTrader 4, MetaTrader 5, and WebTrader

- Rich and very useful educational material for traders

- Offers access to over 10,000 trading assets

- No fees on deposits

- Fast and digital account opening/verification

- No inactivity fees

Cons

- A limited number of platforms

- The portfolio is mostly limited to CFDs

FP Markets Fact sheet

| Main features | |

| Regulations | Australia, Cyprus, St. Vincent and the Grenadines |

| Fees on deposits | 0 USD for Credit Card and Domestic Bank Wire. Other payment methods cost 0.5%+.from the amount |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 0 USD |

| Minimum deposit | 100 AUD or equivalent |

| Minimum account activation | 100 AUD |

| Number of available assets | 10,000+ |

| Leverage up to | 1:500 |

| Available trading markets | Bonds, Commodities, Cryptocurrencies, Forex, Indices, Metals, Stocks |

| Account currencies | AUD, USD, EUR, GBP, SGD, CAD, CHF, HKD, JPY, PLN |

| Demo account | Yes |

| Live account types | Standard, Raw |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 63 available pairs |

| Shares | 0 |

| Cryptocurrencies | 11 |

| Indices | 16 |

| Commodities | 11 |

| Total | 10,000+ |

| Fees & spread | |

| Forex | From 0 pips. 0.2 Avg spreads on EUR/USD Raw account |

| Shares | N/A |

| Cryptocurrencies | From 1. 15.5 Avg spread on BTC/USD |

| Indices | From 1. 0.51 Avg spread on US500 |

| Commodities | From 1. 0.27 Avg spread on US Brent and Crude oil |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Broker to Broker, Credit/Debit Card, E-wallets, Fasapay, Skrill |

| Minimum deposit | Bank Transfer, Broker to Broker, Credit/Debit Card, E-wallets, Fasapay, Skrill |

| Minimum withdrawal | Bank Transfer, Broker to Broker, Credit/Debit Card, E-wallets, Fasapay, Skrill |

| Withdrawal processing time | Up to 1 Business day |

Safety & Security

Every professional trader knows that trading is risky. In order to remain profitable, traders manage their risks by setting limits for themselves. Managing trades through stop-loss orders and keeping a check on your emotions is not enough to live a risk-free life as a trader. As such, it’s important to be well-informed before you entrust your hard-earned money to financial institutions. The biggest indicator of whether a broker is trustworthy or not is how well-regulated the institution is. FP Markets is regulated by ASIC (Australian Securities and Investments Commission) and CySEC (Cyprus Securities and Exchange Commission).

Policies that FP Markets

FP Markets is mainly focused on keeping its customers’ satisfaction levels very high. They are achieving this by providing professional customer service, low fees, high execution speed, a wide range of tradable CFDs, and providing extensive educational material. FP Markets keeps investors’ funds in segregated accounts. The importance of having segregated accounts can not be understated. When a trader deposits money, it must go somewhere. Unreliable brokers keep these funds mixed in with the company’s funds, thus making it easier to have control over their clients’ money. This leads to problems down the line if the company goes bankrupt or its accounts get frozen for some reason.

Trading Assets

FP Markets offers a large number of CFDs to its customers to choose from. Trading CFDs gives investors opportunities to profit from price fluctuations without owning the asset. For example, you can trade crypto CFDs and not worry about where to store the tokens. CFD stands for Contract for Difference, and these can be great tools for trading but they are not useful for long-term investors.

Forex trading

Forex trading is a very popular activity around the world, however, only a small percentage of traders make profits. It may seem like an easy way to make a quick buck, but becoming a profitable trader requires hard work, great educational material, and supportive technical tools. Most beginner traders start trading to make easy money but most traders, who are actually making money consistently, are very hard-working. FP Markets offer over 60 FX pairs to its clients. You can trade all major pairs. Major pairs are the most liquid ones and offer lower spreads. Some examples of major pairs are EUR/USD, GBP/USD, JPY/USD, etc. Leverage on FP Markets is 1:500, meaning you can get up to 500 times exposure to the FX markets using “borrowed” money. It’s important to take into account that the higher the exposure to any single trade, the higher the risk of blowing your trading account, so choose the amount of leverage wisely. FP Markets offer raw spreads if you open a “Raw account” and the spreads start from 0 pips. Spreads are the difference between the bid and an ask price. Keep in mind that the higher the liquidity in the markets, the lower the spread. Usually, liquidity decreases before major financial news, as most investors base their trading decisions on this. Spreads are higher in exotic pairs, as those pairs are less liquid. Beginner traders should be more careful when trading exotic pairs as trading these assets requires in-depth knowledge about the currencies in question and traders will face more risk due to higher spreads. Examples of exotic pairs: Euro/TRY (Turkish Lira), USD/NOK (Norwegian Krone), USD/DKK (Danish krone), etc.

Stock CFDs trading

FPMarkets offers 10 000+ tradable Shares and stock CFDs. Traders can profit from price movements in any direction. You can find a wide range of CFDs coming from NYSE, NASDAQ, London, Hong Kong, Paris, Frankfurt, Madrid, and Amsterdam. Leverage goes up to 500:1. It’s important to take into account that stocks move very differently than currencies. Some traders that fail to become consistently profitable currency traders, find success in trading stocks and vice versa. By providing share CFDs, investors get an amazing opportunity to test themselves in different markets.

Indices trading

FP Markets provides a wide variety of indices. Trading index CFDs allows investors to benefit from price movements in both bullish and bearish markets without actually owning the asset. The most popular indices are S&P 500, Dow Jones Index, NASDAQ 100, etc. It’s important to note that even if you avoid trading indices, keeping an eye on their movement is beneficial if you are investing in any asset. For instance, S&P 500 or Standard and Poor’s 500 is an index that tracks the movement of America’s 500 largest listed companies. If the S&P 500 is bullish, it’s very plausible that the American economy is doing well and this might translate into a stronger USD.

Cryptocurrency trading

For some, cryptocurrencies are the future of money, for others, they are just another example of a pyramid scheme. Whether you believe in the future of cryptocurrencies or not, you can still make money trading crypto CFDs on FP Markets. FP Markets offers the 5 most traded cryptos on its platforms: Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. Leverage is up to 500:1 for all CFDs on FP Markets. Keep in mind that high leverage can increase your profits, but it can increase your losses too. Managing risk is one of the most important features of a consistently profitable trader.

Commodities trading

Commodities are raw materials from which consumer goods can be created. FP Markets offers more than 10 commodity CFDs, such as crude oil, gold, silver, platinum, palladium, copper, aluminum, steel, iron, coffee, natural gas, soybeans, corn, and wheat. When choosing a commodity to trade, it’s important to choose an asset that’s liquid, meaning there are a large number of buyers and sellers. Trading highly liquid assets can ensure that the difference between the ask and bid price will be minimal, making it cheaper for you to enter and exit trades. Leverage is 500:1 when trading commodities on FPMarkets’ platforms. You can trade the CFDs 5 days a week, 24 hours a day, from 5 PM EST Saturday to 4 PM EST Friday.

Account Types Available

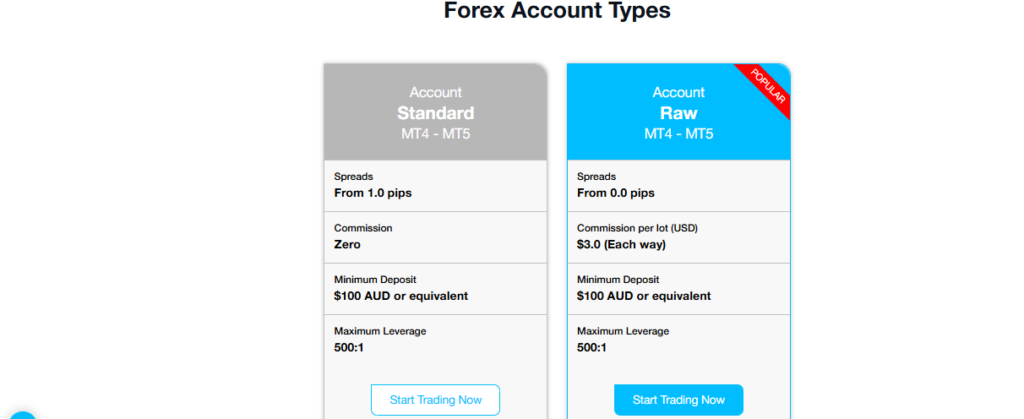

In general, brokers offer different types of accounts for different kinds of investors. Some investors are day traders and make 100 trades a day. Some prefer making 1 or 2 trades every 2 to 3 days. Therefore, some prefer accounts with raw spreads, while for others fixed spreads are more attractive. FP Markets offers 2 account types for FX traders: Standart account and Raw account. Both accounts are supported by the MT4 and MT5 platforms as well as their mobile apps. The minimum initial deposit is 100 AUD for both and they both offer the same amount of instruments and up to 500:1 leverage. However, there are some differences between the two and we’ll discuss them in a bit more detail. Choosing an account type can make or break a trader, as fees, asset variations, and policies are linked to certain accounts.

| Pros | Cons |

| Accounts available for both retail and professional traders | There is no micro account version |

| Offers access to the Iress platform | |

| Only 100 AUD is required to open a live account |

Demo Account

Demo accounts are an essential part of learning the ropes of trading. They are also very useful after you become a professional trader as a tool to test your new strategies. Almost all Forex brokers provide free demo accounts and FP Markets is no exception to this rule. In order to demo-trade the huge amount of assets offered by the broker, you need to install MetaTrader 4 or MetaTrader 5 on your PC. Keep in mind that MetaTrader 5 offers a larger amount of tradable assets while MetaTrader 4 is a more efficient platform for trading currencies. For many traders using a demo account might be a challenge as there’s no emotional connection between the trader and the outcome of his/her trades. When real money is at stake, the whole game changes. Greed, fear, and frustration come into play. That being said, these problems are the only ones you want to have when opening a live account. Can you imagine how difficult live trading would be if you didn’t have a reliable trading strategy on top of these problems? For refining strategies, demo trading is the best. But, if you are struggling to motivate yourself to sit in front of a computer trading with fake money, you can open a 100 AUD account and test your trading skills for real. Remember to only trade with money you can afford to lose.

Standard Account

Standard accounts are preferred by many professional and novice traders as they offer prices and execution that meet the needs of many kinds of traders. FP Markets’ Standard account charges no commission and requires a small opening balance of 100 AUD. The account offers access to 70+ products and the leverage goes up to 500:1. Customers have access to a vast variety of products across Forex, commodities, and indices. Moreover, the broker allows you to open multiple trading accounts. On the other hand, spreads are higher compared to other account types for the Standard account. Spreads start from 1 pip.

Raw Account

Usually, raw accounts keep low spreads and charge commissions on each traded lot. Raw pricing might be more attractive for active day traders, due to the fact that they offer real, uninterrupted prices, sometimes raw trading is called ECN (Electronic Communication Network) trading. Raw trading provides very tight spreads. Sometimes spreads can be as low as 0.0 pips, especially when highly liquid assets are traded. The Raw account offers up to 500:1 leverage and access to more than 70 assets, across commodities, Forex, and indices. However, commissions start from $3 per lot each way.

Iress Account

For more seasoned traders, FP Markets provides access to the Iress accounts. The Iress platforms provide direct order execution for trading CFDs without the participation of intermediaries. However, leverage is limited to a max of 20:1. If you decide to use the Iress platform you can choose from the 3 account types. Iress accounts might be the perfect fit for intraday traders who value speed of execution and direct access to the markets.

Islamic Account

For Muslim traders, interest rates go against the Quran’s teachings and many brokers offer swap-free accounts to make trading accessible for them. Swap-free accounts charge no fees for overnight positions, instead, an administration fee is issued for the Islamic account holder. For Muslim accounts, FP Markets offer the MetaTrader 4 and MetaTrader 5 platforms. Keep in mind that the broker does not provide swap-free accounts on its Iress platform.

Fees & Commissions

FP Markets offers reasonable prices. In general, prices are linked to the account type you choose. The Standard account has a 1 pip markup on every trade but requires 0 commission. The Raw account on the other hand offers spreads from 0 and asks for 6 USD commission per lot traded. At the end of the day, you will still have to pay the broker for your trades but in general, fees are not high.

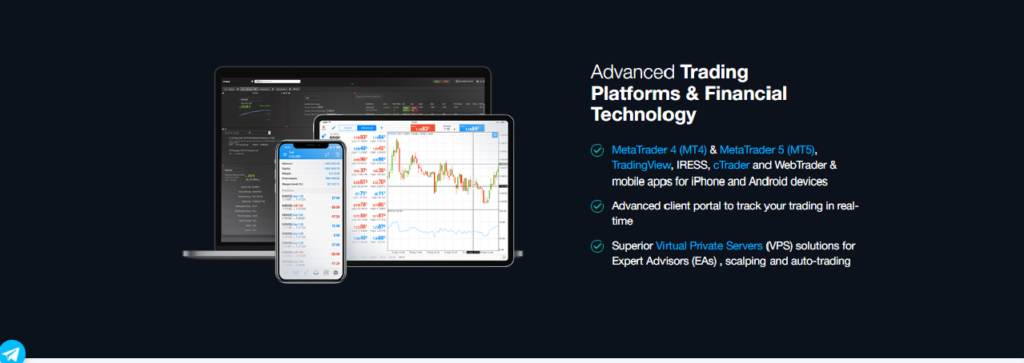

Trading Platforms

FP Markets offer the 2 most popular platforms to its customers; MetaTrader 4 and MetaTrader 5. MetaTrader 4 is the most popular trading platform throughout the world and is mostly used for trading currency pairs.

MetaTrader 4 was created by a Russian company named MetaQuotes in 2005. MetaTrader 5 is a newer version and it offers access to more trading assets. In general, both platforms are widely used and have all the necessary tools to trade profitably. However, it’s worth mentioning that there are other trading platforms, offered by other brokers, that are more user-friendly for novice traders, such as cTrader.

Mobile Trading

Mobile trading tools are important to keep in touch with your trades and can be a lifesaver in emergency situations. In general, most profitable traders know their stop-loss and take-profit targets before they go into a trade, however, some prefer to get out of the position manually and a great mobile app is really important in cases such as these. In addition, a mobile app is your plan B when the power goes out or your laptop suddenly faces internet problems. FP Markets offers a user-friendly mobile app that can be helpful for depositing funds into your account, opening and closing trades, and keeping track of your trading.

Education and Research Tools

Most new Forex investors lose money and blow up their accounts. The biggest reason why there are so many failing traders is a lack of education, lack of discipline, and inability to control their emotions. FP Markets offers trading courses, webinars, podcasts, event news, video tutorials, ebooks, economic calendars, and technical and fundamental analyses to its traders. The Forex market is never static, it’s always evolving and in order to stay at the top of your game as a trader, you will need to work hard and stay dedicated.

Customer Support

Having good customer support is a super important feature when considering which broker to choose. Great customer support can save you precious time, energy, and money. FP Markets provides customer support in 12+ languages, live chat is available 24/7, and you can always send them an email, call them, or request a callback. In addition, you can contact them using several social media accounts. The customer support is very friendly and helpful. The FP Markets’ Trustpilot rating is 4.9 stars. You don’t get such a rating without a professional team of customer support agents.

Latest Brokers

FXTM

FxPro

XTB

Tickmill

AvaTrade