XM Review

Main summary

Founded in 2009, XM has grown to become one of the leading online Forex brokers in the world. With over 5 million clients from as many as 190 countries, XM Is one of the most established brokers currently online.

XM offers traders a wide range of trading assets from Forex to CFDs on stocks, indices, commodities, and the like. Over the past decade, this broker has gotten licenses from leading regulatory agencies worldwide, including the FCA of the UK, CySEC of Cyprus, ASIC of Australia, and so on.

XM is known for charging very low fees and the spreads on major pairs start from as low as 0.6 pips. In today’s XM review, we are going to discuss all the important aspects that make this broker one of the leading companies in the Forex industry. So without further ado, let’s see what XM really has to offer.

Pros and Cons

Cons

- Licensed in five jurisdictions

- Offers over 1,200 assets

- High-quality and extensive research and educational material, including videos, podcasts, detailed guides, and articles

- Full MetaTrader suite available, including MT4 & MT5 with numerous indicators & tools

- Opening an account takes less than a day

- Does not charge withdrawal fees and spreads are very low, starting at 0.6 pips

- The minimum deposit to open an account is just $5

Pros

- Charges inactivity fee

- Limited product portfolio when compared to industry leaders

- Platforms do not offer safer, two-step login

XM Fact sheet

| Main features | |

| Regulations | Cyprus, Australia, UAE, UK, Belize |

| Fees on deposits | $0 |

| Fees on withdrawal | $0 |

| Inactivity fees | $15. $5 per month after 90 days of inactivity |

| Minimum deposit | $5. Minimum initial deposit for Shares Account is 10,000 USD |

| Minimum account activation | $5. Once an account is archived, it cannot be reactivated |

| Number of available assets | 1200+ |

| Leverage up to | 1:1000. There’s no leverage available for Shares account |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, Forex, Indices, Stocks |

| Account currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| Demo account | Yes |

| Live account types | Micro, Standard, XM Ultra Low, Shares Account |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 57 |

| Shares | 100 |

| Cryptocurrencies | 31 |

| Indices | 14 |

| Commodities | 8 |

| Total | 1200+ |

| Fees & spread | |

| Forex | From 0.6. For Micro and Standard accounts, spreads start from 1 pip |

| Shares | From 0. As per the underlying exchange |

| Cryptocurrencies | From 0.0017. Spreads on BTC/USD start from 39 |

| Indices | From 0.00010 |

| Commodities | From 0.3 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Minimum deposit | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Minimum withdrawal | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Withdrawal processing time | Instant |

| Time to open an account | – |

The Safety & Security

When choosing a broker to trade with, one of the important factors to keep in mind is the safety and security of the broker. There are several things that can define the safety and security of the broker you choose to use. One of the main things to focus on is the regulatory guidelines that a certain broker follows. While working on the XM broker review, we found that they are regulated in five different jurisdictions. Here is the list of licenses held by XM:

- Cyprus Securities and Exchange Commission;

- Australian Securities & Investments Commission;

- Dubai Financial Services Authority;

- Financial Conduct Authority, UK;

- International Financial Services Commission, Belize.

These licenses allow XM to offer services to traders in different parts of the world. Thanks to the CySEC license, this broker has access to the whole European market, while the license from Belize allows it to offer services to numerous jurisdictions around the world.

Policies that XM follows

Available Assets on XM – What Can You Trade?

There are over 1,200 assets available for traders to choose from on XM. While this might not sound like much, especially compared to other leading brokerages in the market, it should still be enough to give traders the opportunity to easily find the kind of trades they might be looking for. Traders can have access to all of these available assets with any account. However, keep in mind that shares can only be traded with the special Shares account. As for CFD shares, they can be traded with other accounts as well.

Forex

Shares

When it comes to trading markets, investing in stocks is the way to go for many people. Thus, it is quite important for brokers to ensure they offer these assets to their clients. There are two ways for individuals to trade shares on XM. The first option is very common for brokers in the market today, namely, trading stocks as CFDs. This method includes traders making certain predictions about the possible direction prices could take and then opening contracts according to their predictions. While this is a very common way of trading stocks today, not everyone is really into this strategy. For those who prefer not trading CFDs, XM offers a special “Share Account”, which allows traders to buy and sell shares of leading companies directly.

Indices

Commodities

There are 8 different commodities available on XM. This includes soft and hard commodities such as cocoa, coffee, copper, and many others. Trading commodities can be done using CFDs. This means that rather than buying the commodities directly, the clients of XM simply speculate on the possible price movements of these assets. Commodities can play a huge role when it comes to portfolio diversification.

Cryptocurrencies

Digital currencies are some of the most popular assets today. On XM, they can be traded as CFDs. There are five crypto assets available for clients of XM. For these XM allows traders to use leverage of up to 1:250, which is quite high. The crypto market can be accessed 24 hours a day, 7 days a week. Among the crypto assets that can be traded on XM are BTC, BCH, ETH, LTC, and XRP. Digital assets can be great for investors to diversify their portfolios.

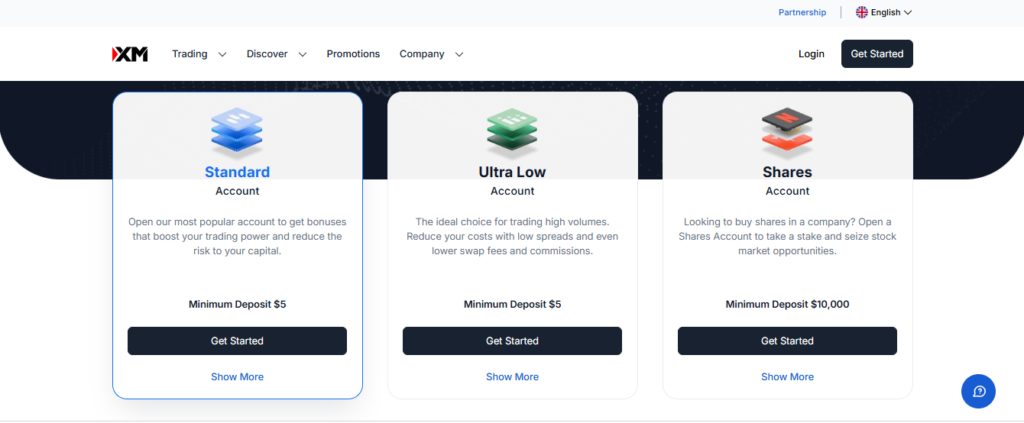

Account Types

Standard account

Ultra-low account

Shares account

If you are a trader looking for the opportunity to directly invest in stocks, there is a great offer waiting for you at XM. For stock investors, XM has created a special account type called a Shares account. This account offers you the opportunity to directly invest in some of the leading stocks around the world. However, there are some conditions that should be kept in mind by traders. First, there is only one base currency option for this type of account – USD. The contract size is 1 share, and there is no leverage available for share account holders. The spreads are greatly variable and depend on the underlying exchange. In addition to this, in order to create this account, you will be required to deposit at least $10,000. This is unlike any other account type offered by the broker, where the minimum deposit to open the account is just $5.

Fees & Commissions

Inactivity fee

Trading Platforms

When we worked on this XM review, we focused on many different factors. One of the biggest concerns that many traders have when deciding on which broker to use is the available trading platforms. The list of XM trading platforms is very diverse. Here, you can find the most popular trading platforms such as MetaTrader 4 and MetaTrader 5, or go with the custom-made trading platform of XM. The broker also offers a web-based trading platform, which can be quite comfortable for many traders. Especially those who do not want to download additional applications to their computers.

Mobile Experience

There is also a mobile application available for the trading platforms offered by the broker. This makes it very user-friendly and ensures that no matter where you go, you will always be able to keep in touch with the Forex trading market.

Education & Research Tools

There is a wide array of educational material available on XM. The broker offers everything from simple Forex guides to different types of educational courses and videos that provide beginners with very detailed information about the market. There are numerous research tools available for traders, to ensure that they are able to understand price movements in greater detail. The broker also offers daily analysis and news articles, to keep you in touch with the most important events happening in the market.

Customer Support

One of the biggest advantages of XM is that it has a highly skilled and professional team of customer support agents. These specialists are always able to provide traders with accurate and timely information about the questions they might face. There are several options to contact the customer support team of XM. First, you can do so through the live chat available on the website of the broker. The second option is to send the customer support team an email, and the third option is directly calling the customer support hotline.

Latest Brokers

FXTM

FxPro

XTB

Tickmill

AvaTrade