| 🔎 Broker | 🥇 Tickmill |

| 📌 Year Founded | 2014 |

| 👤 Amount of Staff | Approximately 100 |

| 👥 Amount of Active Traders | Over 100,000 |

| 📍 Publicly Traded | None |

| 📈 Regulation | FCA CySEC FSA |

| 📉 Country of Regulation | UK, Cyprus, Seychelles |

| 📊 Account Segregation | ✅Yes |

| 💹 Negative Balance Protection | ✅Yes |

| 💱 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | 5+ |

| 💶 Minimum Deposit | $100 |

| ⚡ Average Deposit/Withdrawal Processing Time | 1-2 business days withdrawals |

| 💵 Fund Withdrawal Fee | Generally free |

| 📌 Spreads From | 0.0 pips (ECN accounts) |

| 💷 Commissions | Variable |

| 🔢 Number of Base Currencies Supported | Over 50 |

| 💳 Swap Fees | Applicable |

| ⭐ Leverage | Up to 1:500 (Forex trading) |

| 📍 Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | Available for a fee |

| 📈 CFDs – Total Offered | 80+ |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📊 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets |

| 🖥️ Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| 🖱️ Forex Trading Tools | Advanced charting,, market analysis tools |

| ⭐ Customer Support | ✅Yes |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | +44 20 8089 0385 |

| 💙 Social Media Platforms | Facebook, Twitter, LinkedIn |

| ⚙️ Languages Supported on Tickmill Website | Multiple |

| ↪️ Education and Research | ✅Yes |

| 📔 Forex Course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📚 Educational Resources | Comprehensive |

| 🤝 Affiliate Program | ✅Yes |

| 🫰🏻 IB Program | ✅Yes |

| ⭐ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| 🎁 Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

Tickmill is a well-established online trading service provider known for offering high-quality trading products and services, supported by advanced technology. As part of the Tickmill Group and regulated by the Seychelles Financial Services Authority (FSA), the company has earned a strong reputation for financial stability and consistent growth.

Tickmill caters to both retail and institutional traders worldwide. It provides excellent trading conditions, fast execution, and a secure trading environment. With over 400,000 satisfied clients, Tickmill continues to empower traders by supplying the necessary tools and resources to help them achieve their trading goals.

Advantages Over Competitors

Tickmill sets itself apart from competitors by offering ultra-low spreads starting from 0.0 pips and competitive commissions, making it an ideal choice for traders focused on reducing trading costs. Regulated by leading authorities such as the FCA, CySEC, and FSA, Tickmill upholds a high level of trust and transparency with its clients.

Additionally, Tickmill offers flexible trading conditions, including leverage of up to 1:500, negative balance protection, and no restrictions on strategies like scalping or hedging, accommodating a wide range of trading styles. With advanced platforms like MetaTrader 4 and MetaTrader 5, which come equipped with powerful charting and analysis tools, Tickmill provides comprehensive resources to enhance the trading experience.

The broker also offers multilingual customer support through live chat, phone, and email, ensuring that traders receive prompt assistance whenever necessary.

Safety and Security

Tickmill prioritizes the protection of client funds by implementing stringent security measures. The broker offers insurance coverage for funds ranging from $20,000 to $1,000,000 in the unlikely event of insolvency.

Client funds are held in segregated accounts with reputable banks, ensuring they remain separate from the company’s assets. Additionally, Tickmill provides negative balance protection, ensuring that traders can never lose more than their initial deposit.

Financially stable and well-capitalized, Tickmill maintains adequate liquidity to weather challenging market conditions. With regulation across several jurisdictions, including the FCA, CySEC, FSA, and FSCA, the broker guarantees a high level of security and trust for its clients.

Sign-up Bonus and Promotions

Tickmill offers a range of promotions aimed at enhancing the trading experience. These include the Trader of the Month award, the NFP Machine promotion to capitalize on NFP volatility, and a Welcome Account Bonus for new clients. Active traders can also benefit from the Rebate Promotion, which offers cashback based on trading volume. These promotions demonstrate Tickmill’s dedication to rewarding and supporting its traders.Minimum Deposit and Account Types

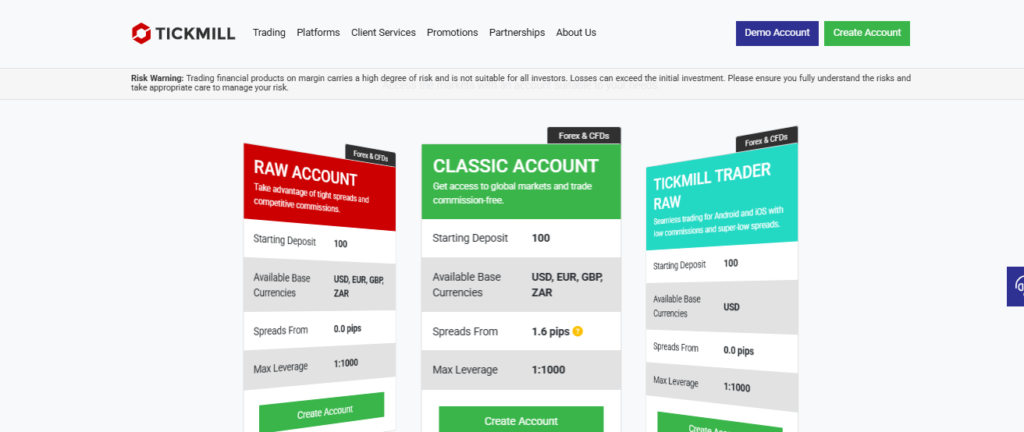

Tickmill offers a variety of live Forex trading accounts designed to suit different trading styles and experience levels. Whether you’re a beginner or an experienced trader, you can select from several account types, including Classic, Raw, and Tickmill Trader Raw accounts.

These accounts feature competitive conditions such as low minimum deposits, tight spreads, and high leverage options. With spreads starting from as low as 0.0 pips and no commissions on the Classic account, Tickmill ensures traders benefit from excellent trading conditions.

Moreover, all accounts support a wide range of strategies, including scalping and hedging, and offer the option of a swap-free Islamic account.

How to Open a Tickmill Account

1. Step 1: Account Creation To start, click the green “Create Account” button located at the top right of the Tickmill homepage. 2. Step 2: Registration Fill out the registration form, providing details such as your country of residence and client type. 3. Step 3: Confirmation After submitting the form, you will receive a confirmation email to verify your account creation.Trading Platforms

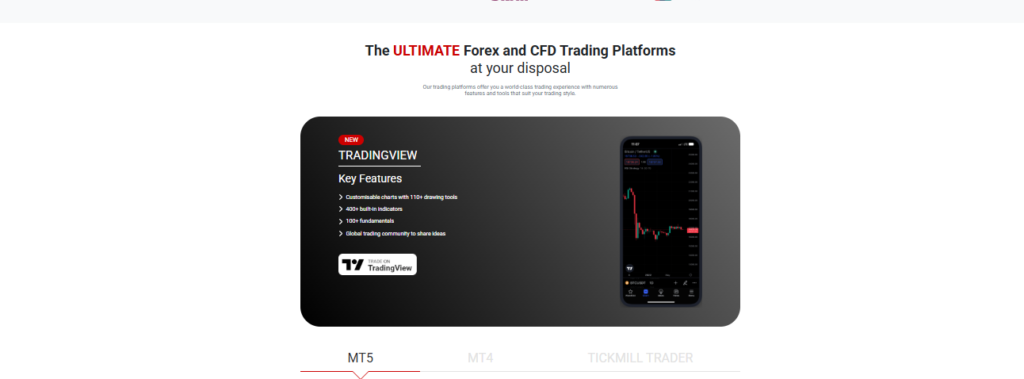

Tickmill provides a range of trading platforms that meet the diverse needs of traders. MetaTrader 4 (MT4) offers a user-friendly experience with advanced charting tools, technical indicators, and automated trading capabilities, making it suitable for both beginners and experienced traders. MetaTrader 5 (MT5) builds on the MT4 experience by adding features such as more timeframes, an economic calendar, and improved order management tools, creating a more comprehensive trading environment.

The Tickmill Trader platform is a mobile app that offers secure login options and seamless switching between demo and live accounts. It also provides real-time market data, account management, and trading features, giving traders the flexibility to manage their trades and accounts from anywhere.

Deposits and Withdrawals

Tickmill offers a wide variety of secure and convenient deposit and withdrawal methods, allowing traders to manage their funds with ease. Whether you prefer bank transfers, cryptocurrency, or e-wallets such as Visa, MasterCard, Skrill, and Neteller, Tickmill ensures fast processing times for both deposits and withdrawals.

For deposits of $5,000 (or equivalent) and above, Tickmill offers a Zero Fees Policy, covering transaction fees up to $100 per month. Withdrawals are typically processed within one business day and are completed in the base currency of the trader’s wallet.

Fees, Spreads, and, Commissions

Tickmill offers competitive fees, tight spreads, and transparent commission structures across its various trading accounts. The Classic account, for example, comes with no commissions and spreads starting from 1.6 pips.

In contrast, the Raw and Tickmill Trader Raw accounts feature spreads as low as 0.0 pips, with commissions of $3 per lot per side for the Raw account and $3.50 per lot per side for the Tickmill Trader Raw account. These low spreads and competitive commissions make Tickmill an attractive option for traders seeking cost-effective trading conditions.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Strong regulation | Limited platform options |

| Full MetaTrader suite | Less competitive pricing on Classic account |

| Low minimum deposit | Commission fees on Raw Accounts |

| Competitive spreads | Limited educational resources |